In June 2018,sba 7a loan vs 504 TKH Group N.V. (

AMS:TWEKA

) released its earnings update. Generally, analysts seem cautiously optimistic, with earnings expected to grow by 17% in the upcoming year relative to the past 5-year average growth rate of 16%. By 2020, we can expect TKH Group’s bottom line to reach €102m, a jump from the current trailing-twelve-month €87m. I will provide a brief commentary around the figures and analyst expectations in the near term. Readers that are interested in understanding the company beyond these figures should

research its fundamentals here

.

Check out our latest analysis for TKH Group

Exciting times ahead?

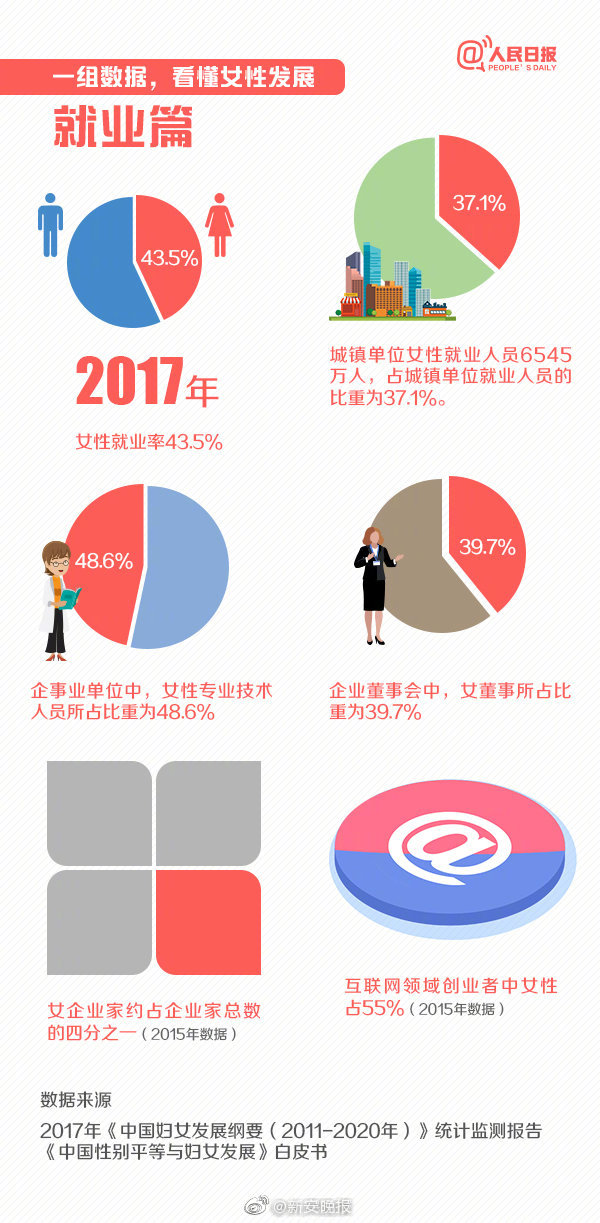

Over the next three years, it seems the consensus view of the 5 analysts covering TWEKA is skewed towards the positive sentiment. Since forecasting becomes more difficult further into the future, broker analysts generally project out to around three years. To reduce the year-on-year volatility of analyst earnings forecast, I’ve inserted a line of best fit through the expected earnings figures to determine the annual growth rate from the slope of the line.

ENXTAM:TWEKA Future Profit January 3rd 19

From the current net income level of €87m and the final forecast of €143m by 2022, the annual rate of growth for TWEKA’s earnings is 16%. This leads to an EPS of €3.9 in the final year of projections relative to the current EPS of €2.08. In 2022, TWEKA’s profit margin will have expanded from 5.9% to 7.7%.

Next Steps:

Future outlook is only one aspect when you’re building an investment case for a stock. For TKH Group, there are three relevant factors you should further research:

Financial Health

: Does it have a healthy balance sheet? Take a look at our

free balance sheet analysis with six simple checks

on key factors like leverage and risk.

Valuation

: What is TKH Group worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The

intrinsic value infographic in our free research report

helps visualize whether TKH Group is currently mispriced by the market.

Other High-Growth Alternatives

: Are there other high-growth stocks you could be holding instead of TKH Group? Explore

our interactive list of stocks with large growth potential

to get an idea of what else is out there you may be missing!

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at

.

View comments